How to Find Owners of Properties

in Hawaii

The Uniform Information Practices Act (UIPA) makes researching property information in Hawaii easy. The UIPA gives the public access to government records, including property records.

Local government agencies can help you access this information so you can discover who owns the property that interests you. Let's go through some of the resources you can tap, including your professional service options for a property owner search in Hawaii.

Visit the Bureau of Conveyances

The Bureau of Conveyances is where the state of Hawaii stores all property-related records, like deeds, mortgages, and liens. It's the main resource to find an owner of property free of charge in Hawaii. The Bureau manages two main systems: the Regular System and the Land Court. Together, they keep a complete record of property transactions going back to the Great Māhele of 1848.

Unlike most places with county-specific offices, Hawaii keeps property records at a central location in Honolulu. If you're looking to find ownership records, you need to have any of these details to initiate the search:

- Property Address – The street address of the property

- Tax Map Key (TMK) – Hawaii's unique ID number for properties

Each county has a property tax assessment office. You can even access some records online. Here are links for online searches by county:

- Honolulu County: Real Property Assessment Division

- Hawaii County: Real Property Tax Office

- Maui County: Real Property Assessment Division

- Kauai County: Real Property Assessment Division

Maui County holds the records for the fifth county of Kalawao.

Check Land Records

Hawaii keeps track of land records through two main systems, both managed by the Bureau of Conveyances. The Regular System and the Land Court System handle property transactions and help confirm ownership.

- Regular System: This system logs deeds and documents that transfer ownership. When someone sells or buys property in Hawaii, a deed is created and sent to the Bureau of Conveyances, where it’s recorded. While this system makes ownership public, it doesn’t fully guarantee title.

- Land Court System: Created in 1903, this system is more secure and follows the Torrens title approach. Here, you submit an application and documents proving ownership to the Land Court. If the court approves, you get a certificate of title, which provides solid proof of ownership.

Hawaii's Bureau of Conveyances (BOC) offers several ways to check land records online and in person.

- Online Document Search: You can search the BOC's online database for documents recorded since January 1976. Setting up a free account lets you browse and order copies of property records.

- Property Watch Alerts: Sign up for Property Watch to get alerts via email about any activity on properties you're interested in. Just note that any errors in public records or your search terms could affect the results.

- In-Person Access: For older records, the Public Reference Room in Honolulu is open during weekdays. Here, you can look up records recorded before 1992.

- Recent Record Requests: If you need a document from the past 60 days, send an email to dlnr.bc.faq@hawaii.gov. The check number used to pay the recording fee should be included.

Go to the Assessor's Office

Hawaii's local assessor's offices keep useful records for property details and taxes. You can typically find the following information:

- Property Assessment Records: These show the assessed value of properties for calculating property taxes.

- Tax Records: These cover tax rates, payment history, and exemptions that apply.

- Ownership Information: This includes the current owner's name and address, as well as any past ownership details.

- Land Use and Zoning: Information on how to legally use the property based on zoning laws.

If you're looking to find a property owner, you can visit your local assessor's office. Here's how:

- Visit the Office: Go during business hours, but check ahead to see if you need an appointment.

- Bring Key Information: To help with the search, provide the property's address or the Tax Map Key (TMK) number.

- Request Records: Once there, you can ask to see public records. There may be a fee for copies.

Review Property Tax Records

In Hawaii, local assessor's offices keep property tax records that offer key details about ownership, property values, and tax history. These records are helpful for both property owners and buyers. Property Tax records often include:

- Current Ownership: Shows the current owner's name and contact information.

- Assessed Values: Lists the property's assessed value, which is used to figure out taxes owed.

- Tax History: Records past tax payments, dates, amounts, and any outstanding balances.

- Exemptions: Details any tax exemptions, like homestead exemptions or other relief programs.

In Hawaii, you can access property tax records both online and in person. Here are links for online searches by county.

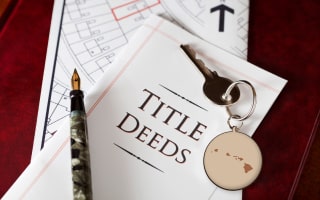

Hire a Title Company

You'll get property titles that are clear and free of any issues from title companies, also known as title agencies. They dig into property records, check for any liens, and offer title insurance to protect buyers and lenders from future ownership disputes.

Title Searches: Title companies access extensive records, including past ownership, liens, and mortgages. They create a full ownership history for each property, ensuring the title is clear before the sale.

Title Insurance: Once the title search is complete, title companies offer insurance to cover any potential future claims or legal disputes over the property.

The cost of a title search varies per county. The price can go up if the search is more complex or involves additional services like document preparation or escrow.

![]() Outsource to a Commercial Service Provider

Outsource to a Commercial Service Provider

Websites like PropertyChecker.com can help you look up property ownership details, although they may not cover everything you'd find in official government records. These sites let you search across Hawaii to find current and previous property owners, including any entities or trusts linked to the property.

To use PropertyChecker.com for Hawaii property records, follow these steps:

- Visit the Site: Head to Hawaii PropertyChecker.com.

-

Enter Search Information: You can use any of the following:

- Property Address

- Owner's Name

- Owner's Phone

- Owner's Email

- Parcel ID

-

View Results: After searching, you'll see a list of matching properties. Results often show:

- Names of current and past owners

- Ownership history

- Any related entities or trusts

- Explore Property Details: Click on each property for more information, like assessed values, tax history, or any liens tied to it.

Other Ways to Do a Hawaii House Owner Lookup

Besides title companies, there are several ways to find out who owns a property:

- Ask Neighbors: Sometimes, nearby residents know the property owner.

- Check With Real Estate Agents: Local agents often have access to property details and can help with ownership information.

- Hire a Real Estate Lawyer: A real estate attorney can do a property search and advise you on ownership questions.

What Are the Different Types of Property Ownership in Hawaii?

Property ownership gives you specific rights and claims over a piece of real estate. These rights can look different depending on who's involved, whether you own it alone, with a spouse, or with others. Knowing the different ways to hold a property title helps you make informed decisions, affecting areas such as risk, liability, financing, probate, and taxes.

Choosing how to structure property ownership affects the following:

- Risk and Liability: Different setups can expose you to more or less liability.

- Financing Options: Some types of ownership can influence mortgage options.

- Probate: The way you hold a title may decide if a property goes through probate after passing.

- Taxes: Ownership type can affect your tax obligations and potential benefits.

In Hawaii, you'll find two main types of property ownership: fee simple and leasehold.

- Fee Simple: This is the most common. You fully own the land and any structures on it. You have complete control, so you can sell, lease, or pass it down however you like. You'll still need to pay property taxes and follow local laws.

- Leasehold: Here, you own the buildings or improvements on the land but not the land itself. You lease it from a fee-simple owner. Leasehold properties often cost less upfront and might have lower taxes. Keep in mind that you'll pay rent for the land and that ownership may revert to the landowner when the lease ends unless renegotiated.

Beyond these, there are other less common ways to hold property titles. Each of these options provides different rights and responsibilities, so choose the one that best suits your needs and long-term plans.

| Ownership Type | Benefits | Implications |

|---|---|---|

| Fee Simple | Full control over the property | Responsible for taxes and rules |

| Leasehold | Lower purchase cost | Pay lease rent; may revert later |

| Tenancy in Severalty | Sole ownership and control | Subject to probate upon death |

| Tenancy in Common | Flexible shares and inheritance | No survivorship rights |

| Joint Tenancy | Survivorship rights | All must agree on changes |

| Tenancy by the Entirety | Spousal creditor protection | Requires mutual consent |

| Condominium | Shared amenities access | Must follow HOA rules |

| Cooperative | Lower cost, shared duties | Limited management control |

| Planned Unit Development | Community setup with amenities | HOA fees and rules apply |

| Timesharing | Set usage time annually | Can have complex agreements |

Finding the Owner of a Trust or Corporation That Owns Properties in Hawaii

In Hawaii, property ownership can extend beyond individuals to include entities like trusts, corporations, partnerships, and LLCs. If you're trying to find a property owner by address held by one of these groups, there are ways to get the information you need. Many people choose to get help from real estate attorneys or title companies, as these professionals have experience with public records and business databases.

Finding the Owner of a Trust in Hawaii

To find the owner of a trust:

-

Check Public Records

- Property Deeds: Visit the Bureau of Conveyances, which may list the trust as the property owner.

- Tax Records: Property tax records sometimes mention ownership by a trust.

-

Contact the Trustee

- If the trustee's name is available in public records, try reaching out directly for information about the trust.

-

Seek Legal Assistance

- If you need more guidance, a real estate attorney with expertise in trusts can provide further help.

Finding the Owner of an LLC in Hawaii

To find the owner of an LLC in Hawaii:

-

Use the Hawaii Business Express Tool

- Go to the Hawaii Business Express site of the Hawaii Department of Commerce and Consumer Affairs (DCCA).

- Use the Search tool to look up the LLC by name.

-

Review Search Results

- The search provides information like the LLC's registered agent, status, and filing history. You can often see documents about ownership and management.

-

Contact DCCA for More Information

- For further questions, reach out to the DCCA.

Finding the Owner of a Corporation in Hawaii

To find the owner of a corporation in Hawaii:

-

Look Up Business Registration Records

- Go to the DCCA Business Registration site and search by corporation name.

-

Check Corporate Filings

- The results will include information on officers, directors, and registered agents. Annual reports and other filings may reveal details on ownership.

-

Ask DCCA for Clarification

- If you need more specifics, you can contact the DCCA BREG.

Common Methods of Property Transfer in Hawaii

A property deed is a document used to transfer ownership of real estate. It lists the seller (grantor) and the buyer (grantee) and includes a legal description of the property. For it to be official in Hawaii, the grantor needs to sign it, and a notary must acknowledge it before it's filed with the Bureau of Conveyances.

If you're interested in property ownership details or how to find the owner of a property by address, a deed can provide this information. It's a reliable source for confirming who holds the title to a property.

In Hawaii, different types of property deeds serve various purposes. These are the main types of deeds:

- Quitclaim Deed: This deed transfers whatever ownership the grantor has, even if they don't hold the full title. It's often used to clear up issues with a title or for transfers between family members.

- Gift Deed: It allows a property transfer without any money changing hands.

- Warranty Deed: Commonly used in property sales, this deed guarantees that the grantor has full ownership and the right to transfer it.

- Special Warranty Deed: It is similar to a warranty deed but only covers the time the grantor owned the property.

- Grant Deed: This deed transfers ownership and guarantees that the grantor hasn't sold the property to anyone else.

- Correction Deed: It is used to fix errors in an already recorded deed.

- Transfer on Death Deed: Also called a beneficiary deed, it lets you designate someone to inherit the property. It's signed and recorded now but only goes into effect after you pass away.

Other types of property documents include easement deeds, mortgage agreements, and promissory notes.

Step-by-Step Guide to Property Transfer in Hawaii

Here are the steps involved in officially transferring property ownership in the state of Hawaii:

- Choose the Deed Type: Decide on a deed based on what works best for your situation.

- Do a Title Search: Check for any liens or claims on the property. You can do this through the Bureau of Conveyances or hire a title company.

- Prepare the Deed: Fill out the deed with all required details, including names, a property description, and a notary's acknowledgment.

- Pay Transfer Taxes: Calculate and pay any transfer taxes based on the property's sale price.

- Record the Deed: Submit the signed deed along with the recording fees to the Bureau of Conveyances. For the Regular System, the fee is $41 for documents up to 50 pages and $106 for documents with 51 pages or more. For the Land Court, the fee is $36 for documents up to 50 pages and $101 for those with 51 pages or more.

- Get a Copy of the Recorded Deed: Once processed, keep a copy of the recorded deed as proof of the transfer.

- Update Local Tax Records: Update tax records with the new owner's details to ensure accurate billing.

- Consider Title Insurance: If needed, get title insurance to protect against any future claims. The conveyance tax is 10 cents per $100 for property transfers under $600,000, increasing to $1.00 per $100 for transfers over $10 million.

Property Ownership Guide

Hawaii Homeowner Lookup

- Owner(s)

- Deed Records

- Loans & Liens

- Values

- Taxes

- Building Permits

- Purchase History

- Property Details

- And More!